In the absence of the new tax reform planned by the government - delayed by the coronavirus crisis - the draft 2021 budget leaves room for more equity and displays new ambitions in environmental matters.

In addition to the government's efforts on the thorny issue of access to housing (on this subject, see the blog "budget project 2021: a brake on real estate speculation, a desire to make housing accessible to households"), the new tax provisions are clearly beneficial to green projects and investments in housing.

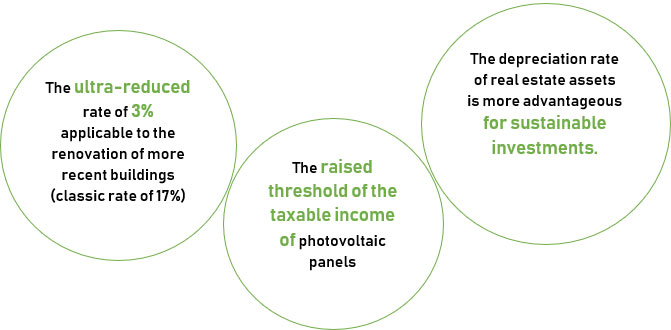

While knowing that real estate taxation will generally increase for individuals, let's see how to benefit from these new tax reductions by investing green, according to three new provisions :

Here is a summary table

|

|

CURRENT ARRANGEMENTS |

DRAFT BUDGET 2021 |

|

|

Ultra-reduced rate of 3% applicable to building renovations |

Buildings more than 20 years old |

Buildings more than 10 years old |

|

|

Photovoltaic panel income |

Production less than 4kW tax free |

New threshold higher than 4Kw still to be defined |

|

|

Amortization of assets |

Rate of 6% for all depreciation and amortization applicable over 6 years |

Classical assets |

Assets eligible for Prime House |

|

5% over 5 years |

6% over 10 years |

||

*Amortization of assets depends on the maximum amortization rate set by the government. Amortization is the recognition of the loss in value of your asset over time (wear and tear). In a real estate company, it allows you to spread the cost of your investment over its useful life. Each year, it therefore recognizes the loss in value of the asset. This loss corresponds to an expense, so that it is deducted from your income, in other words, it allows you to revalue your assets downwards and thus reduce your taxable profit. Understand that the higher this rate is, the less tax you will pay, and this for 10 years if your investment complies with the Prime House criteria! (the Prime House criteria that you will find on the national structure myenergy.lu)

Sustainable investment is thus largely favored by the new tax provisions, and the renovation of old buildings with more environmentally friendly solutions is strongly encouraged. The increased depreciation of eco-friendly assets, the increase in the threshold of taxable income from sustainable electricity production, the ten-year guarantee (a 10-year guarantee against potential hidden defects following the construction of a building), the 3% VAT rate for the construction of a new property that complies with standards, and the significant reduction in electricity consumption, should also encourage households to build, and thus allow the sale of old buildings in favor of the purchase of an environmentally - and fiscally - sustainable property.